Cryptopolytech (CPT) Public Press Pass (PPP)

News of the Day COVERAGE

200000048 – World Newser

•| #World |•| #Online |•| #Media |•| #Outlet |

View more Headlines & Breaking News here, as covered by cryptopolytech.com

Bitcoin Witnesses Historic Whale Exodus: What You Need To Know appeared on www.newsbtc.com by Jake Simmons.

Bitcoin whales are witnessing a historic exodus. @CryptoVizArt, a senior researcher at Glassnode has shed light on the significant shifts within the whale cohort in a new analysis.

Bitcoin Whales’ Impact: Unveiling The Numbers

In a remarkable revelation, the research highlights the substantial impact of whales on recent market activity. According to the data, “34% of sell pressure in the last 30 day was from Binance whales.” These influential entities have been instrumental in shaping the recent market dynamics.

Moreover, the research also highlights a trend in whale behavior: a noteworthy decline in the total balance of whale entities on exchanges. In the last 30 days, the report states, “Whale Flow to Exchanges witnessed the largest monthly balance decline in history, hitting -148,000 BTC/month.” This dramatic decline marks a significant shift within the whale cohort, raising intriguing questions about their motives and strategies.

As the market witnessed the rally above $31,000, the influx of whale funds to exchanges surged remarkably. Glassnode’s data reveals that whale inflow volumes reached an impressive +16,300 BTC/day, signifying their active involvement in recent market movements. Notably, this whale dominance accounted for 41% of all exchange inflows, which is comparable to both the LUNA crash (39%) and the failure of FTX (33%).

Throughout June and July, whale inflows have sustained an elevated inflow bias of between 4,000 to 6,500 BTC/day. Among all exchanges, Binance emerged as the primary destination for whale inflows. The report discloses that around 82% of whale-to-exchange flows were heading into Binance. In contrast, Coinbase accounted for 6.8%, and all other exchanges account for 11.2%.

While the overall balance of whales may have declined, @CryptoVizArt’s analysis points to intriguing internal dynamics within the whale cohort. As some whales increased their balances, others experienced declines. This phenomenon led the researcher to introduce the concept of ‘Whale Reshuffling,’ suggesting that not all whales follow the same strategy.

The examination of the whale cohort over the last 30 days shows that whales with more than 100,000 BTC have recorded an increase of +6,000 BTC, whales with 10k-100k BTC have decreased their account balance by -49.0k BTC and whales with 1k-10k BTC have increased their account balance by +33.8k BTC. However, in aggregate, the whale group has seen just -8.7k BTC in net outflows.

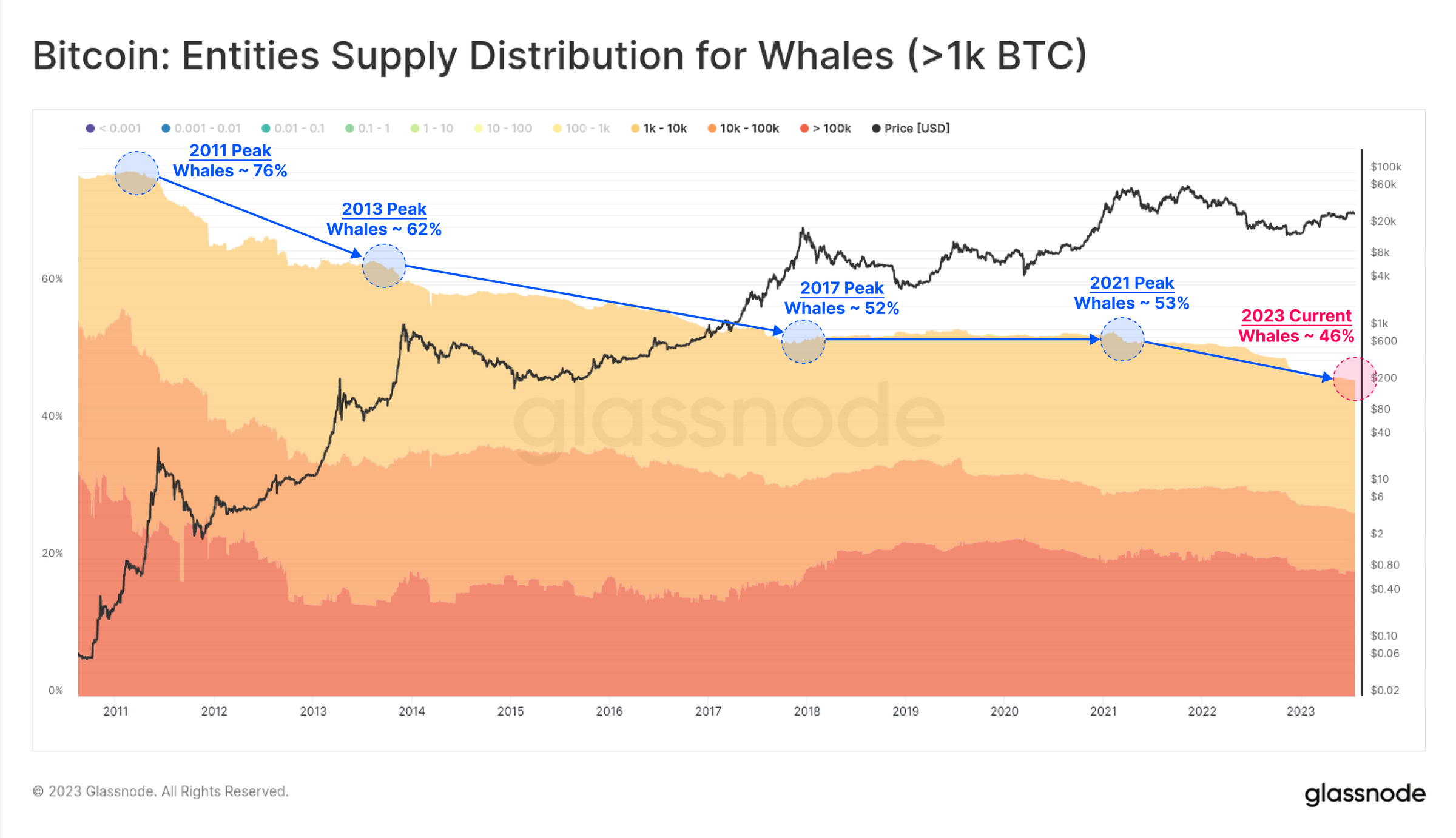

Remarkably, whale entities now account for only 46% of the total supply, down from 63% at the beginning of 2021. Since the early days of Bitcoin, a steady downward trend can be observed.

Short-Term Holders: The Driving Force

The research also sheds light on the dominance of short-term holders (STHs) among the whale entities. The data indicates that STHs represent a significant portion of recent trading activity, actively trading the market. This behavior is evident as market rallies and corrections lead to notable upticks in profit or loss among this group.

Short-Term Holder (STH) Dominance across Exchange Inflows has exploded to 82%. This is drastically above the long-term range over the last five years (typically 55% to 65%). “From this, we can establish a case that much of the recent trading activity is driven by Whales active within the 2023 market and thus classified as STHs”, states the analyst, adding, “each rally and correction since the FTX fallout has seen a 10k+ BTC uptick in STH profit or loss, respectively.”

BTC whale transactions can therefore currently be a good indicator. However, special attention also needs to be paid to the STHs, which will eventually run out of bullets at some point.

At press time, the BTC price stood at $29,203.

FEATURED ‘News of the Day’, as reported by public domain newswires.

View ALL Headlines & Breaking News here.

Source Information (if available)

This article originally appeared on www.newsbtc.com by Jake Simmons – sharing via newswires in the public domain, repeatedly. News articles have become eerily similar to manufacturer descriptions.

We will happily entertain any content removal requests, simply reach out to us. In the interim, please perform due diligence and place any content you deem “privileged” behind a subscription and/or paywall.

CPT (CryptoPolyTech) PPP (Public Press Pass) Coverage features stories and headlines you may not otherwise see due to the manipulation of mass media.

First to share? If share image does not populate, please close the share box & re-open or reload page to load the image, Thanks!