Cryptopolytech (CPT) Public Press Pass (PPP)

News of the Day COVERAGE

200000048 – World Newser

•| #World |•| #Online |•| #Media |•| #Outlet |

View more Headlines & Breaking News here, as covered by cryptopolytech.com

DeFi Researcher Questions Injective Protocol's Appeal: Is INJ Overvalued? appeared on www.newsbtc.com by Dalmas Ngetich.

Thor Hartvigsen, a data-driven decentralized finance (DeFi) researcher, is questioning the appeal of Injective Protocol, a layer-1 platform whose creators say is designed to expressly power finance.

As of December 2023, INJ, the native currency of Injective Protocol, is one of the top-performing coins, surpassing Bitcoin (BTC) and Ethereum (ETH).

Is Injective Protocol Undervalued Based On On-Chain Metrics?

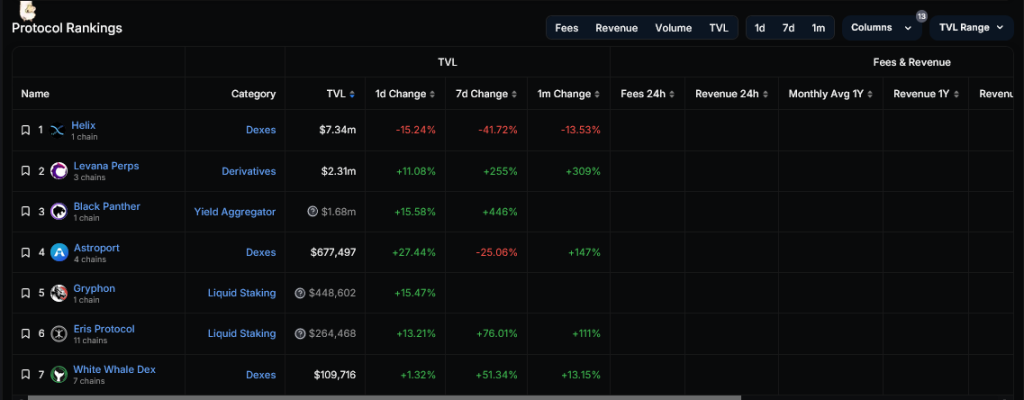

Taking to X on December 14, Hartvigsen highlighted the platform’s relatively low total value locked (TVL) of $11 million and the limited number of protocols launched on the platform, currently standing at seven.

Based on the researcher’s analysis, the largest dapp on the layer-1, Helix Protocol, a decentralized exchange (DEX), only manages a daily trading volume of about $7.4 million.

Hartvigsen states this is significantly lower than other perpetual futures protocols, including the Perpetual Protocol. These competitors, the analyst notes, are valued at around $200 and $300 million based on fully diluted valuation (FDV).

So far, looking at data, there are only seven active protocols on Injective, with Helix managing over 60% of the ecosystem’s TVL, reinforcing its dominance.

If on-chain activity and the number of active protocol leads, Hartvigsen wants answers to irrefutably justify Injective Protocol’s $3.2 billion valuation.

The researcher compares Injective with other blockchains, including Ethereum and Solana. These platforms command relatively higher trading volume and on-chain activity.

To illustrate, Hartvigsen cites DefiLlama data, which shows that Injective’s volume ranges from $5 to $7 million daily from seven dapps.

On the other hand, Solana, a competing layer-1, presently processes between $500 and $700 million. Meanwhile, Injective Protocol cannot match Ethereum, which processes over $1 billion in trading volume.

INJ Up 395%, Will Prices Continue Rising On Investor Optimism?

In response to Hartvigsen’s analysis, yiggit, a user claiming to be a legal counsel, defended Injective Protocol. The user emphasized that TVL, as the researcher cited, cannot be the sole determinant to gauge a project’s potential.

Related Reading: Bitcoin Deja Vu: Capital Inflows Mirror Pre-2021 Bull Run Momentum

Yiggit added that Injective Protocol’s potential is rooted in the expected number of upcoming apps. Notably, the legal counsel notes that optimism also stems from the Injective Protocol’s origins in Cosmos. In the Cosmos ecosystem, staking tends to catalyze participation as users seek to receive airdrops.

Still, whether or not the researcher’s assessment is valid depends on time. So far, looking at the INJ price action in the daily chart, the coin has been charting higher, registering new all-time highs.

To illustrate, INJ is up 395% from mid-October 2023, rallying as the broader crypto market recovers. At this valuation, CoinMarketCap data shows that the project has a market cap of over $2.7 billion.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

FEATURED ‘News of the Day’, as reported by public domain newswires.

View ALL Headlines & Breaking News here.

Source Information (if available)

This article originally appeared on www.newsbtc.com by Dalmas Ngetich – sharing via newswires in the public domain, repeatedly. News articles have become eerily similar to manufacturer descriptions.

We will happily entertain any content removal requests, simply reach out to us. In the interim, please perform due diligence and place any content you deem “privileged” behind a subscription and/or paywall.

CPT (CryptoPolyTech) PPP (Public Press Pass) Coverage features stories and headlines you may not otherwise see due to the manipulation of mass media.

First to share? If share image does not populate, please close the share box & re-open or reload page to load the image, Thanks!