Ahead of the Ethereum Shanghai upgrade, investors move money from altcoins into this sector | CPT PPP Coverage

Cryptopolytech (CPT) Public Press Pass (PPP)

News of the Day COVERAGE

200000048 – World Newser

•| #World |•| #Online |•| #Media |•| #Outlet |

View more Headlines & Breaking News here, as covered by cryptopolytech.com

Ahead of the Ethereum Shanghai upgrade, investors move money from altcoins into this sector appeared on www.fxstreet.com by Aaryamann Shrivastava.

- Ethereum Shanghai upgrade has driven the staking hype in the market, but the interest is shifting toward Lending protocols.

- In the month leading up to staking withdrawal on the world’s biggest DeFi chain, liquid staking protocols have noted minimal growth in the total value locked on them.

- The staking hype could end up being a bubble since investors would go back to reward-yielding options of Lending protocols.

Ethereum has been building on the Shanghai upgrade for months now, and with less than a few days left to go, investors’ interests seem to be shifting. It might happen to be so that the staking hype might not live long, and the money could flow back into this sector of the crypto market.

Money moves out of altcoins

The rising dominance of Bitcoin is seemingly triumphing over the altcoins, as their market cap has remained virtually unchanged since mid-February. The total value of all cryptocurrencies, excluding Bitcoin, was expected to note an increase, but the market capitalization is hovering around $613 billion, the same high it was seven months ago in September 2022.

Altcoin market capitalization

Regardless, the crypto market is still anticipated to do well, given the depreciating conditions of the broader TradFi markets. Ethereum is expected to be the leader of the better market with its introduction of staking withdrawal on the chain. This is because the Shanghai upgrade will unlock $36 billion worth of ETH, which would increase the liquidity in the market.

However, before this could happen, the subsiding alt-season narrative could result in investors pulling out of altcoins and focusing on the more flourishing Decentralised Finance (DeFi) market.

Liquid staking may not sustain the hype

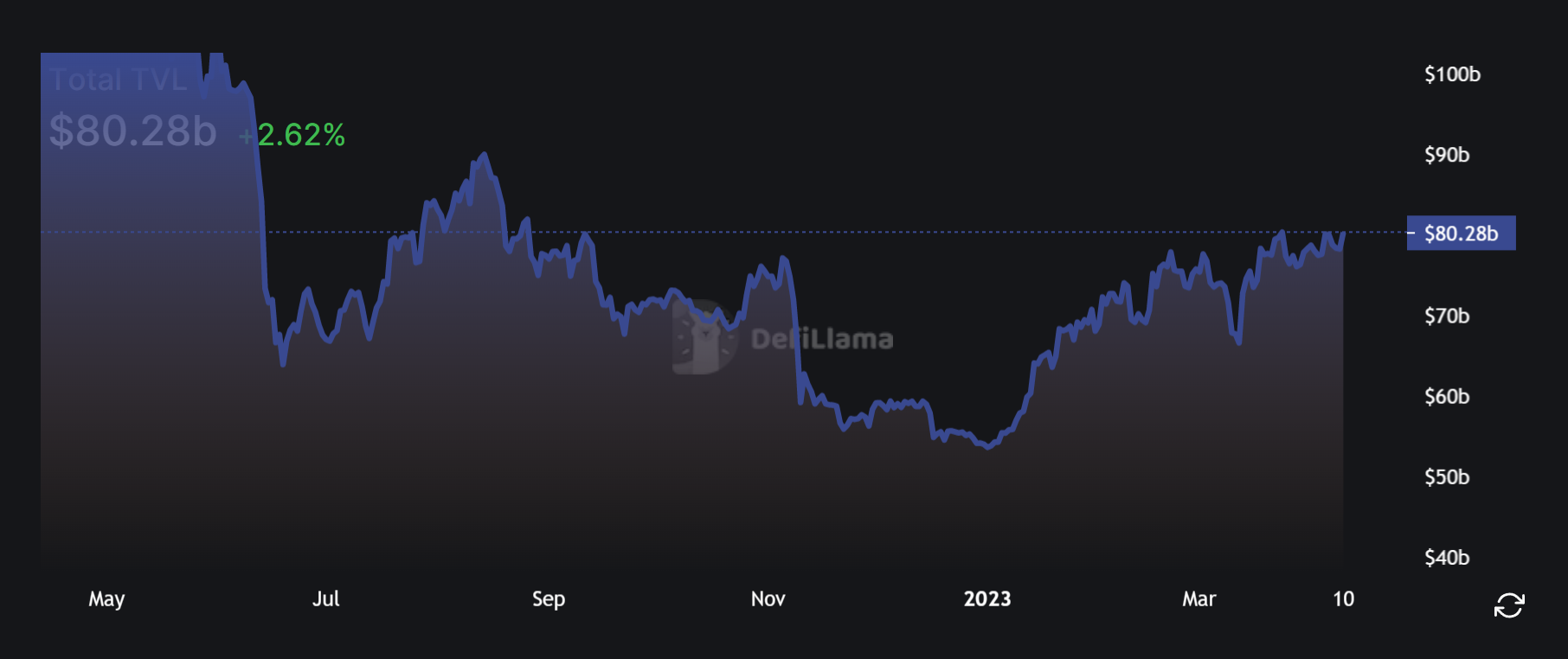

The DeFi market has grown by over $14 billion in a month, even as the rest of the crypto market struggled to gain. The total value locked (TVL) across the blockchains increased from $66 billion to $80 billion, rising to a seven-month high.

DeFi market TVL

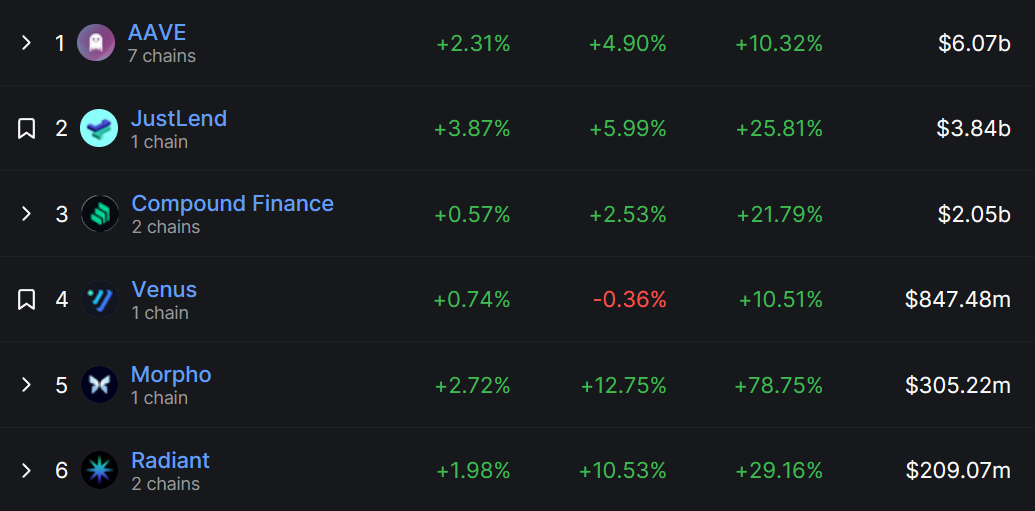

Investors seem more interested in Lending protocols than Liquid Staking protocols at the moment. This is despite the Ethereum Shanghai hype that has been a key driving factor for Liquid Staking Derivative tokens.

The Lending protocols have noted a higher increase in TVL over the month in comparison to staking. The likes of Compound Finance and Tron-based JustLend have grown by 25% and 21%, respectively, in terms of inflows. Recently emerging decentralized application Morpho, too, gained over $300 million in TVL, rising by 79% in the same duration.

Lending protocol TVL change

On the other hand, some of the topmost Liquid Staking protocols’ total value has only observed a growth of 10% on average. Except for Lido Finance and Coinbase Wrapped Staked ETH, each grew by 16% and 20%, respectively, not many observed significant gains in the month leading up to the Shanghai upgrade.

This suggests that investors potentially consider the staking hype to be a bubble. A reason behind this could be that despite the availability of choice, people are not going to actually withdraw their staked ETH.

Furthermore, this staking hype is actually seemingly time being, as once the market reels from the Shanghai upgrade, the focus will go back to investing in rewards-yielding options. As discussed before, social cues are a key driving factor for the crypto market and have proven to be the reason behind rallies and crashes, which is also the case for the staking hype at the moment.

To understand the impact of social cues on the crypto market in further detail, read more at – Why these social cues could be forecasting a local top for Ethereum and the broader crypto markets

FEATURED ‘News of the Day’, as reported by public domain newswires.

View ALL Headlines & Breaking News here.

Source Information (if available)

This article originally appeared on www.fxstreet.com by Aaryamann Shrivastava – sharing via newswires in the public domain, repeatedly. News articles have become eerily similar to manufacturer descriptions.

We will happily entertain any content removal requests, simply reach out to us. In the interim, please perform due diligence and place any content you deem “privileged” behind a subscription and/or paywall.

CPT (CryptoPolyTech) PPP (Public Press Pass) Coverage features stories and headlines you may not otherwise see due to the manipulation of mass media.

First to share? If share image does not populate, please close the share box & re-open or reload page to load the image, Thanks!