Cryptopolytech (CPT) Public Press Pass (PPP)

News of the Day COVERAGE

200000048 – World Newser

•| #World |•| #Online |•| #Media |•| #Outlet |

View more Headlines & Breaking News here, as covered by cryptopolytech.com

Bitcoin ETFs outperform Ether ETFs as BlackRock's IBIT leads peers – CoinJournal appeared on coinjournal.net by Charles Thuo.

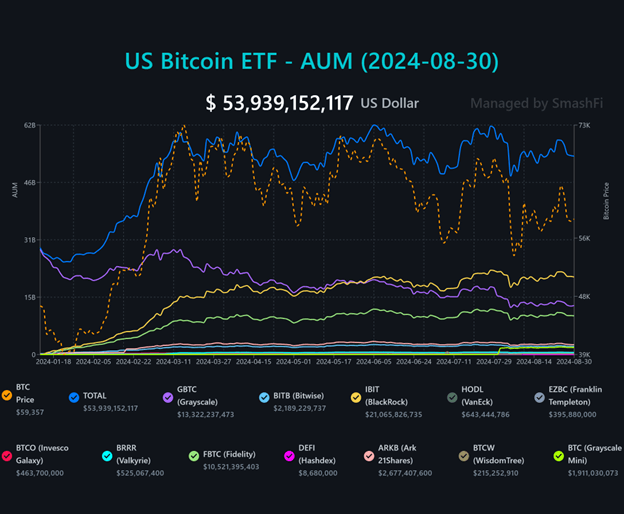

- Bitcoin ETFs have attracted $5B net inflows while Ether ETFs have seen $500M net outflows.

- BlackRock’s IBIT leads with over $224M in a single day, currently holding over 350,000 BTC.

- Ether ETFs are struggling due to liquidity issues and Grayscale’s $2.5B outflows.

Recent trends in the cryptocurrency exchange-traded funds (ETF) market have highlighted a significant divergence in the performance of Bitcoin and Ether ETFs.

Comparing Bitcoin ETF Flow data to Ethereum ETF Flow data on Farside Investors, Ether spot ETFs have underwhelmed compared to their Bitcoin counterparts. Since their launch, Ether ETFs have experienced net outflows of approximately $500 million, a stark contrast to the $5 billion net inflows recorded by BTC ETFs during a similar period following their debut.

Several factors contribute to this disparity. To start with, Bitcoin’s “first mover advantage,” higher liquidity, and lack of staking opportunities in Ether ETFs have made Bitcoin more appealing to institutional investors.

Additionally, unexpected outflows from Grayscale’s Ethereum Trust (ETHE), amounting to $2.5 billion, far exceeding the bank’s initial $1 billion estimate, have further dampened Ether ETF performance. To counter these outflows, Grayscale introduced a mini-Ether ETF, but it has only managed to attract $200 million in inflows.

In contrast, BTC ETFs have shown resilience and robust performance with US-based BTC ETFs recording an impressive eight-day winning streak, with net inflows totalling $202 million led by BlackRock’s iShares Bitcoin Trust (IBIT).

On August 26 alone, IBIT attracted over $224 million in net inflows bringing its total Bitcoin holdings to over 350,000 BTC, solidifying its dominance in the market.

Competing funds such as those managed by Franklin Templeton and WisdomTree also saw positive inflows, while others, including Fidelity, Bitwise, and VanEck, reported negative flows. Notably, Grayscale’s Bitcoin Trust (GBTC) saw a decline in redemptions over the past two weeks, indicating stabilization in the market.

As investor confidence in Bitcoin ETFs grows, asset managers are increasingly exploring combined ETFs that offer exposure to both Bitcoin and Ethereum, reflecting the evolving dynamics of the cryptocurrency investment landscape.

FEATURED ‘News of the Day’, as reported by public domain newswires.

View ALL Headlines & Breaking News here.

Source Information (if available)

This article originally appeared on coinjournal.net by Charles Thuo – sharing via newswires in the public domain, repeatedly. News articles have become eerily similar to manufacturer descriptions.

We will happily entertain any content removal requests, simply reach out to us. In the interim, please perform due diligence and place any content you deem “privileged” behind a subscription and/or paywall.

CPT (CryptoPolyTech) PPP (Public Press Pass) Coverage features stories and headlines you may not otherwise see due to the manipulation of mass media.

First to share? If share image does not populate, please close the share box & re-open or reload page to load the image, Thanks!