Our #TECH_Newser covers ‘news of the day’ #techNewserTechnology content.

| cutline • press clip • news of the day |

Greenhouse Gas from a Surprising Source.

After what seemed an eternity of talk without significant governmental action to combat climate change, the US has passed what some are saying is the biggest climate bill in history. Oddly named, the Inflation Reduction Act commits $740 billion US dollars to target a variety of long-standing concerns — energy production and manufacturing, reducing carbon emissions, lowering prescription prices, and extending affordable healthcare coverage.

Half of the bill’s dollar outlays — $370 billion – will go towards measures to help decarbonise the US economy. Unlike past proposed solutions that failed to make it into law where “sticks” meant to punish polluters predominated, this bill relies strictly on “carrots.” Carbon tax is ancient legal history it would appear, with the current legislation rewarding businesses for doing the right thing via a combination of subsidies, loans, grants, and tax credits.

The overwhelming majority of the global scientific community is in agreement that greenhouse gas emissions are driving the chaotic changes in climate the world is now experiencing, from droughts to floods and more.

The commonly held view is that the leading culprit is carbon dioxide released from vehicular exhausts and electrical generating facilities powered by fossil fuels.

In reality, carbon dioxide is one of three of the major greenhouse gases contributing to climate change. The other two are methane and nitrous oxide. Agricultural production passes all three greenhouse gases into the atmosphere.

In the US agriculture’s contribution is relatively minor – between 10% and 11%. Globally, there is little consistency in estimating how much agricultural production contributes to greenhouse gas emissions – from 20% to 30% and as high a 33%. There is uniform agreement on one thing – agriculture’s greenhouse gas emissions will rise as exploding populations and increasing numbers of middle class consumers will require more and better food.

From what part of the agricultural food chain comes the largest contributor to greenhouse gas emissions? The answer may surprise you. It is enteric fermentation, or animal belching to the more common among us. From Scientific American comes the following breakdown:

According to some experts, synthetic (chemically based) fertilisers in crop production rank second, emitting nitrous oxide, with the carbon dioxide coming from farming machinery and the transport vehicles used to bring goods to market.

The good news is that in the developed world, market forces from the agri-business community to the scientific research community recognise the problem and are working on solutions.

Global food conglomerate US based Cargill already has a product in the market – SilvAir – that reduces methane emissions from enteric fermentation. The arrival of foods substituting plants for the protein supplied by meat products could reduce demand for livestock in the long term and reduce enteric fermentation with it.

Countless small and large farm operations worldwide are searching for and implementing operating procedures that are designed to reduce greenhouse gas emissions.

The technology induced “disruptors” invading multiple business sectors now are working in agriculture, known as Agri-tech companies. Agri-tech companies, as the sector name implies, employ technology solutions to the entire food supply chain, or individual links in the chain, from sustainable food production methods to storage and transportation.

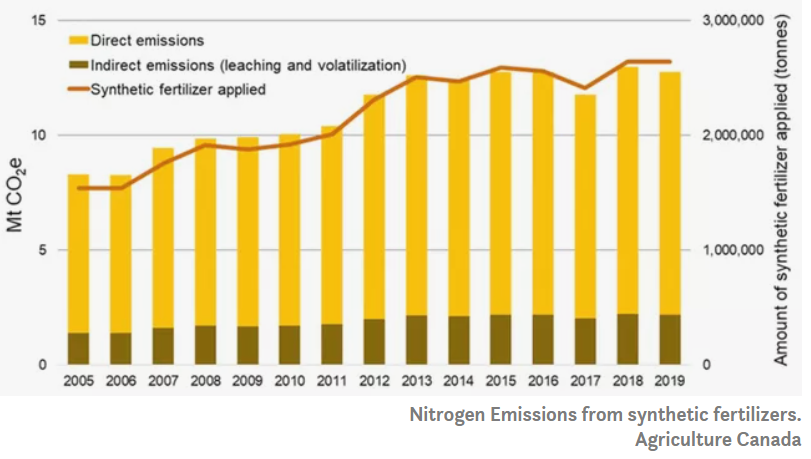

For decades, crop producing land has had the nitrogen removed in the growing and harvesting process replaced by chemically based fertilisers. The nitrous oxide released into the atmosphere is increasing. From the environmental website treehugger.com:

None of the world’s big chemical fertilizer companies are mass producing fertilizers derived from naturally organic sources, although consumers and farmers have a wide variety of choices from smaller companies. Count Australia among them, with no big companies currently producing natural fertilisers.

Given the fact Australia is frequently branded as the “bread basket of Asia,” it is surprising Australia trails in the world in capital investments into the growing Agri-tech sector. In a November of 2018 article in finfeed.com celebrated National Ag Day, highlighting four ASX listed Agri-tech stocks “climbing the beanstalk.” The stocks covered included:

- Roots Agriculture (ROO)

- RotoGro (RGO0

- CropLogic (CLI)

- Abundant Produce (ABT)

Only one is still in business – Roots. It has fallen to sub-penny stock status, with a last closing price of $0.004. RotoGro, CropLogic and Abundant Produce succumbed to a very common problem with start-up companies – they ran out of money. RotoGro was the most recent to fall, with its official suspension from the ASX on 22 August of this year following the bankruptcy of its operations in Canada.

Roots is an Israeli company listing on the ASX. The company has two technologies for optimizing plant growth — Root Zone Temperature Optimisation (RZTO) and Irrigation by Condensation – with both patent protected. Roots has expanded its target markets to include cannabis producers.

RotoGro excited investors when it listed in early 2017 with its rotary hydroponic vertical farming system used for optimal indoor plant growth. The system was automated, powered by the company’s proprietary software, iGrow.

CropLogic offered agricultural growers a proprietary crop modeling system for improving crop yields.

Abundant Produce had partnerships with major universities for its proprietary seed technology.

There are no shortage of Agri-tech startups here in Australia. Research firm Tracxn claims there are 490 of them, with the Tracxn website offering a company overview of the top ten.

Of the three currently listed ASX stocks that can lay claim to the Agri-tech monitor, the most successful has been Wide Open Agriculture (WOA), listing on the ASX on 31 July of 2018. The shares opened at $0.21, dropping to a close of $0.18. On 26 August of 2022, the WOA share price closed at $0.59.

When Wide Open Agriculture began trading, the company’s self-description was a “regenerative food and agriculture” company. The inspiration for founding the company was the founder’s discovery that 34% of carbon emissions comes from the world’s food systems, according to the company website.

Regenerative agriculture is not a single practice, but rather an integrated philosophy of land and crop management gleaned from decades of prior research on organic farming, agroecology, agroforestry, and holistic management. In 2018 Amazon anointed regenerative agriculture as the next largest food trend on the planet.

In traditional farming practice, the nutrients drained from the soil by growing plants are replaced by chemically based fertilisers. Pesticides also are reported to negatively affect natural nitrogen levels in crop soil. Regenerative agriculture focuses on the entire life cycle ecosystem of farming.

Wide Open Agriculture and its subsidiary company’s now sell premium vegetables, branded “Food for Reasons” products, Dirty Clean Food brands of beef and lamb, and the first of its kind milk made from regeneratively grown oats – Dirty Clean Oat Milk.

The share price began to take off in mid-May 2020 when the company announced an agreement with Curtin University to produce and market a lupin-based protein as a replacement for animal protein. Lupin is considered a “super high protein” from legumes. At the time, Beyond Meat was making headlines in the US with its line of meat-free “meats” made with plant-based protein.

The agreement is coming close to fruition as the company announced the opening of a plant based protein production facility in Western Australia, where 60% of the world’s lupin originates. The final product will be dubbed Buntine Protein®.

On 22 August, the company announced that up to twelve Dirty Clean Foods products would find their way onto the selves of Coles Local stores in Western Australia.

Half Year 2022 Financial Results showed an impressive 127% increase in revenue but the company’s posted losses went up 46%. Wide Open Agriculture has increased revenues in each of the last three fiscal years but has yet to show a profit. The company has a market cap of $76 million dollars

Pure Foods Tasmania was born in 2015 and began trading on the ASX in 2020. Pure Foods launched with a startup plan to get into the high-end food businesses in Tasmania, and little else. In short order, the company acquired two premium product lines with the addition of Tasmania Pâté and Woodbridge Smokehouse, a producer of smoked salmon and trout. The final early acquisition was the Daly Potato Company.

The growth strategy was acquisition of complementary companies, with one of them launching Pure Foods into what could be an exploding market – plant-based foods.

The company now owns two providers of plant-based cheeses — Lauds Plant Based Foods and New Pastures – and Cashew Creamery, a producer of plant-based ice cream.

Pure Foods recently completed a successful capital raise, with proceeds devoted solely to growth initiatives in existing operations. On 29 April of this year, Pure Foods released its Results Presentation for Q3 of FY 2022. Revenues rose overall 22%, while revenues from the company’s Plant Based Foods Segment rose 368%, driven by the phenomenal growth of Cashew Creamery where revenues rose more than one thousand percent. Pure Foods Tasmania has a market cap of $15 million dollars and last traded at $0.19 per share.

Bio-Gene Technology is developing chemical free insecticides — Qcide™ and Flavocide™ — based on naturally occurring beta-triketones using the company’s chemistry based processes. –

Bio-Gene developed Flavocide™ in conjunction with the CSIRO (Commonwealth Scientific and Industrial Research Organisation) Advanced Manufacturing, using a new chemical synthesis process with extracted plant materials. The result is a natural insecticide that increases crop yield.

Qcide is in the early stages of development with a steam distillation process to extract the natural oils from the leaves of a rare Australian Eucalyptus.

Both are patent protected. The company has targeted five markets:

- Crop Protection

- Grain Storage

- Public Health

- Consumer Applications

- Animal Health.

Bio-Gene has two commercial agreements in place for mosquito control, one in the US and another here in Australia/New Zealand.

The company has a market cap of $20 million dollars and last traded at $0.115 per share.

‘News of the Day’ content, as reported by public domain newswires.

Source Information (if available)

It appears the above article may have originally appeared on thebull.com.au and has been shared elsewhere on the internet, repeatedly. News articles have become eerily similar to manufacturer descriptions.

We will happily entertain any content removal requests, simply reach out to us. In the interim, please perform due diligence and place any content you deem “privileged” behind a subscription and/or paywall.

First to share? If share image does not populate, please close the share box & re-open or reload page to load the image, Thanks!