Our #TECH_Newser covers ‘news of the day’ #techNewserTechnology content.

| cutline • press clip • news of the day |

The MDA And Rocket Lab Partnership: Opportunity In Satellites.

dima_zel

In my recent article on GlobalStar’s (GSAT) partnership with Apple (NASDAQ:AAPL) for space-based communications, I touched upon the contract awarded to MDA (TSX:MDA:CA) (OTCPK:MDALF), a Canadian company for the construction of the satellites. Now, MDA awarded the contract to transport the satellites to space to Rocket Lab (NASDAQ:RKLB).

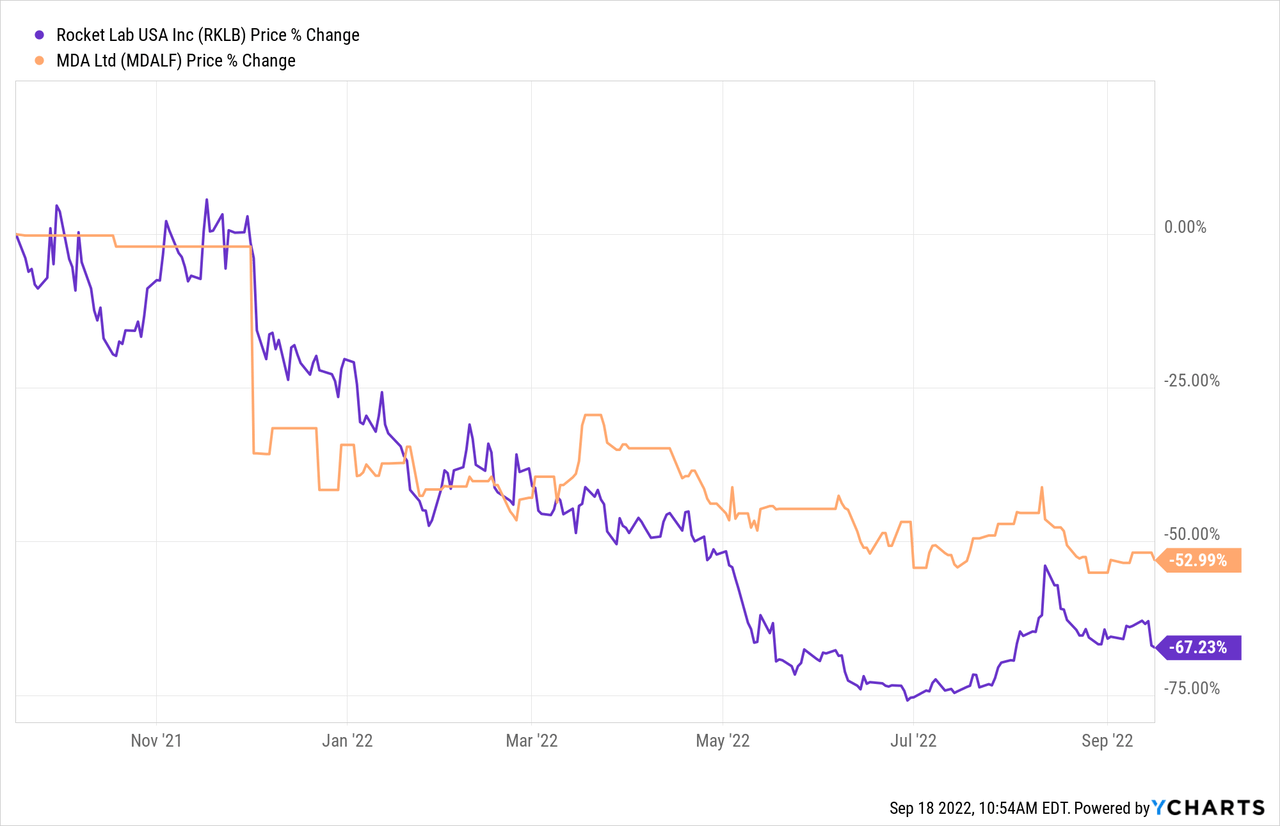

Coincidentally, the shares of both companies have been moving more or less in tandem with each other since March when the contracts were awarded as shown in the chart below.

My aim with this thesis is to elaborate on the opportunities offered by this partnership while also considering the risks in light of the recent developments which have been going on in satellite-based communications.

Satellite-Based Communications

Satellites have revolutionized our ability to communicate around the world since Telstar I was launched in 1962 by NASA in collaboration with AT&T (T). Since then, the number of satellites orbiting the Earth has increased dramatically. However, satellite communications took backstage in the 1990s with the laying of fiber cables across the world’s oceans. In the aftermath of this development, internet traffic traveled primarily through high bandwidth fiber with satellites being used mostly as backup links except for remote locations which were deprived of mobile cellular coverage.

This started to change in the 2010s when satellite-based communications responded to the need for more mobility with services from GlobalStar or Iridium (IRDM) using purposely-built handsets to link up with spacecraft orbiting our planet. These use low earth orbit satellites or LEO, and unlike satellites located at higher altitudes, do not remain fixed with respect to a single location on the earth’s surface. Instead, they move around the planet at very high speeds, making it impossible to depend on a single satellite to provide comprehensive coverage, but rather on a whole constellation of them.

In this respect, GlobalStar’s existing fleet currently consists of 48 satellites, but, it intends to expand to 3080 satellites. This is a huge number and will be attained in different phases, the first one of which will consist of putting into orbit 17 satellites by the end of 2025. These are to be manufactured, assembled, and tested by MDA and the latter has subcontracted the transportation to Rocket Lab which will build space shuttles to put the satellites into orbit.

This means that the two companies will now have to work together in partnership right from building the satellites to having them orbiting in space.

The Partnership Amid Competition

Rocket Lab will cash in $143 million out of the $327 million to be disbursed by GlobalStar. Optionally, there could be an additional 9 satellites for a total value of $102.6 million as I had stipulated in my earlier thesis. These millions represent a significant chunk of the two partners’ revenue as I further detail in the next section.

Image built from www.mda.space and (www.rocketlabusa.com)

Noteworthily, only a few months back, GlobalStar had allotted the contract to build an FM-15 satellite for its second generation constellation to Thales Alenia Space, a subsidiary of France-based Thales (OTCPK:THLLY). Then, with this contract, MDA seems to have unseated competitor Thales, and, in addition to technological reasons, the decision could also be due to geopolitical factors as some European plays have provided earth observation satellites to Russia earlier on, which is not the case for MDA since it had been forbidden to do so by the Canadian government.

Looking further, T-Mobile (NASDAQ:TMUS) has partnered with SpaceX (SPACE) for extending basic mobile coverage in remote locations for people to contact emergency services. Now, SpaceX’s fully-owned subsidiary Starlink (STRLK) is a provider of satellite-based internet service with over 400K subscribers. Thinking aloud, the fact that MDA has chosen to partner with Rocket Lab for the GlobalStar-sponsored venture and not with SpaceX whose Falcon 9 rocket put the FM-15 into orbit in June may point to the fact that the aim is to opt for independent providers or those who are not themselves providing communications services.

This in turn signifies that the partnership could nab more contracts from communication services providers like GlobalStar in the rapidly developing field of the satellite-direct-to-phone market as ground-based telecom infrastructures cost more to implement.

At this stage, it is important to assess the finances.

Assessing the Finances of the two Partners

Being in operation for decades, MDA has other contracts with its technology forming part of over 359 satellite missions. It also provides antenna and electronic subsystems, to around 850 satellites currently in orbit.

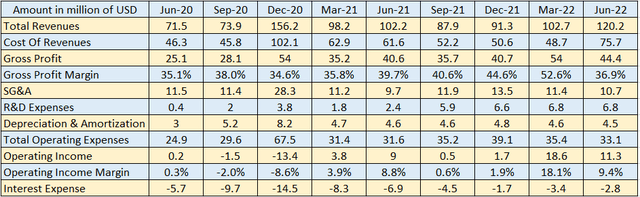

Its second-quarter 2022 (Q2) revenue of CAD$154.7 million or $120.2 million constituted a 22% year-on-year growth as shown in the table below, partly driven by new programs including the GlobalStar project. Furthermore, despite facing higher costs of revenues, the company managed to keep operating expenses under control, thereby delivering an operating income of 9.4%.

Table built using data from (www.seekingalpha.com)

It also reduced its interest payments on borrowing on a sequential basis through refinancing of a senior credit facility, with a healthy debt to equity ratio of 18.3%, and a backlog of CAD$1.52 billion which increased by a whopping 138% over last year.

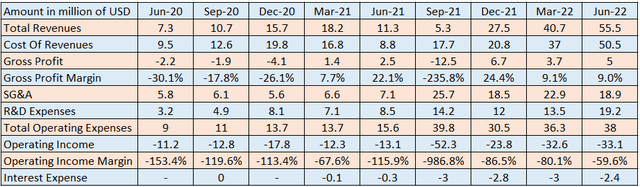

As for Rocket Lab, as a high-growth company, its revenues increased to $55.5 million as shown in the table below, or by 392% on a YoY basis. This is explained by the strong demand for its Electron rockets with one of the launches including the CAPSTONE moon mission for NASA. The sticker price per launch is $7.5 million carrying a payload of 500 kg.

Table built using data from (www.seekingalpha.com)

Rocket Lab has also made progress in reducing interest expenses and its cash of $542.5 million exceeds the $147.6 million of debt. On the other hand, it has a profitability problem, but, from -153% to -59.6% as per the above table, there has been a reduction in the operating loss margin. This should continue as a result of two factors.

First, through the recapture of the booster stage of the Electron rocket, there should be a reduction in fixed costs as the parts can be reused, somewhat like SpaceX does with its Falcon 9 rockets. Profitability can also increase through “responsive launches” which are of an unplanned nature since these come at a premium of 15-20% above the ticker price with the costs being the same as for the normal launches. For this purpose, Rocket Lab is ready with three launch pads across two hemispheres including New Zealand and the U.S. together with facilities to receive, integrate, and launch spacecraft within 24 hours.

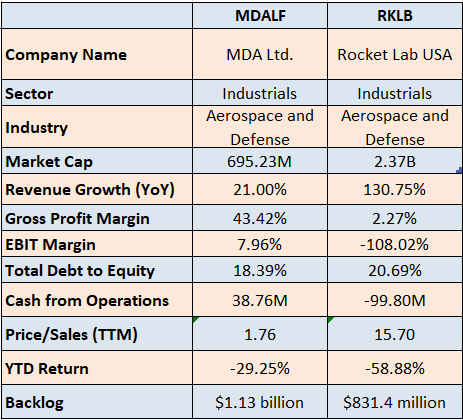

The key financial metrics are lumped in the table below.

Valuing the Partners

Operating in the industrials sector, as part of the aerospace and defense industries, the two companies carry different valuations, which are primarily related to their respective revenue growths. Here, the market has priced in Rocket Lab’s phenomenal annual rate of growth in its price-to-sales multiples of 15.7x as per the table below.

Comparing the key metrics (www.seekingalpha.com)

Even MDA is growing more than two times faster than the global aerospace and defense market whose market size is expected to grow at a CACR of 7.8% from 2021 to 2022. Also, the backlog shows that both companies have at least two years of unfulfilled customer orders.

Normally, you would expect this sort of backlog from companies selling sophisticated guided missiles, but, as demonstrated in Ukraine where the defendants do not necessarily have the best weapon and logistics systems, it is more communications and observation that now play prominent roles in the war zone. Now, these are enabled by satellites that the MDA-Rocket Lab partnership can manufacture and transport into space. Here, just for the communications part, after GlobalStar will enable iPhone subscribers to text emergency services in North America, other contenders are likely to emerge for the Android ecosystem, implying more satellite business.

Conclusion

In some way, this is just the beginning with many opportunities to come, but, this remains a bear market, where only those companies which offer the best profitability and cash metrics are not suffering. Hence, despite all their progress, Rocket Lab and MDA have suffered from downsides of 59% and 29% respectively since the start of 2022 (above table). The pains are probably not over yet and there are risks that the downside may continue as the market braces itself for another 75 basis point rate hike or even higher during the next FOMC meeting. Consequently, unless you hold these stocks for the long term, they mostly constitute trading opportunities for the time being.

First, for Rocket Lab, rocket launches tend to be highly-publicized events and momentum-inducing news could trigger an upside, just as there could be a bounce following the investors’ meeting on September 21 when the company provides updates about its backlog, Neutron rocket, and details as to when it will achieve profitability. Along the same lines, updates on its rocket reusability program and financial results could see the stock flirting again with the $6 level, as it did on August 11 before dropping back.

Next, for MDA, being a profitable company, it has still suffered a downside since August 11, namely after revising its 2022 revenue target downwards, mostly because of delays faced for the Telesat Lightspeed program and some slower government program ramp-ups. Still, with the revised revenue target representing a 30%–35% year-over-year growth, there could be an upside when the company announces a major customer win or positive third-quarter results around November 12. The stock could climb back to its 50-day moving average of $6.3 (or CAD$8.3).

Finally, this partnership does not lack prospects, and both partners have their individual strengths with MDA being profitable while Rocket Lab enjoying ultra-high growth. However, due to market volatility risks, I have a hold position on both stocks. Also, as I mentioned earlier, there are further pains to come and unless you are a trader, it is better to wait for a better margin of safety before investing.

‘News of the Day’ content, as reported by public domain newswires.

Source Information (if available)

It appears the above article may have originally appeared on seekingalpha.com and has been shared elsewhere on the internet, repeatedly. News articles have become eerily similar to manufacturer descriptions.

We will happily entertain any content removal requests, simply reach out to us. In the interim, please perform due diligence and place any content you deem “privileged” behind a subscription and/or paywall.

First to share? If share image does not populate, please close the share box & re-open or reload page to load the image, Thanks!